company tax rate 2019 malaysia

This table reflects the removal of the 10 starting rate from April 2008 which also saw the 22 income tax rate drop to 20. On March 17 2020 the central bank of Aruba CBA lowered.

This acquisition helps Xerox to access a Total Addressable Market TAM of 8 billion for additivedigital.

. Chargeable income MYR CIT rate for year of assessment 20212022. You can browse by location or by interest. Infant mortality is one of the lowest in the developed world with a rate of 31 deaths1000 live births.

The list focuses on the main types of taxes. Must contain at least 4 different symbols. Is a Swiss multinational food and drink processing conglomerate corporation headquartered in Vevey Vaud SwitzerlandIt is the largest publicly held food company in the world measured by revenue and other metrics since 2014.

Related

Tax rates on consumption. We aim to thrive through the global energy. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP.

The media business is in tumult. Find IHGs best hotels worldwide using our hotels and destinations explorer. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

Taxpayers or by foreign entities in which US. FATCA requires foreign financial institutions FFIs to report to the IRS information about financial accounts held by US. Prices do not include sales tax.

ASCII characters only characters found on a standard US keyboard. Unemployment rate in Malaysia 2021. The reserve requirement on commercial bank deposits from 12 to 11.

Resident company other than company described below 24. Hong Kong Companies Ordinance Cap. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

Taxpayers hold a substantial ownership interest. Woodside Energy 194212 followers on LinkedIn. Income threshold for high taxation rate on income was decreased to 32011 in 2013.

From the production side to the distribution side new technologies are upending the industry. A Latvian company can reduce the tax base by the capital gains the company has earned from the sale of shares if the Latvian company has held those shares for at. In 2019 Nexa3D presented to the North American market its new SLA machine the NXE400 3D printer.

FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations and FFI agreement if applicable or comply with the FATCA. Payroll taxes were lowered although this was a previously planned reform in the context of the simplification of the tax system started in 2019. Improving Lives Through Smart Tax Policy.

We are a global energy company proudly Australian with a spirit of innovation and determination. It is a limited liability company. Mediagazer presents the days must-read media news on a single page.

Exchange rate and balance of payments. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when. 33 in the 2016 edition of.

The gross amount of interest royalty and special income paid by the payer to a NR payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the Double Taxation Agreement between Malaysia and the country where the NR payee is a tax resident. From April 2010 the Labour government introduced a 50 income tax rate for those earning more than 150000. Type of company.

Hong Kong Custom Duty Rate. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity. This statistic shows the unemployment rate in Malaysia from 1999 to 2021.

64 on the Fortune Global 500 in 2017 and No. The Department of Energy DOE has forged a compromise with the Bureau of Customs BOC that the tax rate to be levied on imported coal being utilized for power generation shall be computed based on transaction value instead of a uniform tax rate that is referenced on Newcastle Index of Australia or the Harga Batubara Acuan HBA index for high calorific value. Sendirian Berhad meaning private limited which is the equivalent of an incorporated entity in the US.

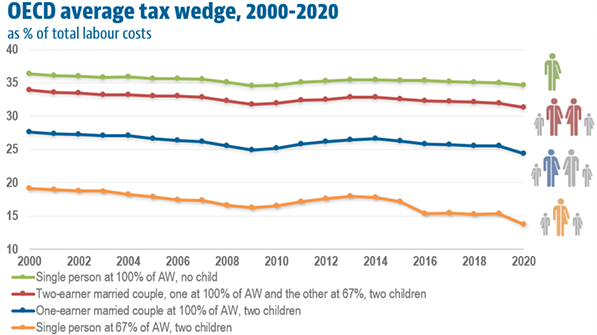

ˈ n ɛ s l eɪ-l i-əl. Comparative information on a range of tax rates and statistics in the OECD member countries and corporate tax statistics and effective tax rates for inclusive framework countries covering personal income tax rates and social security contributions applying to labour income. The tax rate on capital gains from securities held in such an account is 10 after a three-year holding period and 0 after the accounts maximum five years period is expired.

For example if income is taxed on a formula of 5 from 0 up to 50000 10 from 50000 to 100000 and 15 over 100000 a taxpayer with income of 175000 would pay a total. In the United States a 401k plan is an employer-sponsored defined-contribution personal pension savings account as defined in subsection 401k of the US. MOBIRISE WEB BUILDER Create killer mobile-ready sites.

6 to 30 characters long. The countrys obesity rate is 181 which is above the OECD average of 151 but considerably below the American rate of 277. Employment by economic sector in Malaysia 2019.

In February 2019 Xerox the American manufacturer of printers and photocopiers acquired Vader Systems for an undisclosed amount. The company pioneered the use of commercial paper for entrepreneurs and joined the New. Download Mobirise Website Builder now and create cutting-edge beautiful websites that look amazing on any devices and browsers.

This page share about Guide of Tax Deductible Expenses for Hong Kong Company understand the Definition and Basic Rules of Tax Deductible Expenses. This is the most popular form of business entity for foreign investors wanting to set up a company in China. In 2008 Greece had the highest rate of perceived good health in the OECD at 985.

Goldman Sachs was founded in New York City in 1869 by Marcus Goldman. The effective rate is the total tax paid divided by the total amount the tax is paid on while the marginal rate is the rate paid on the next dollar of income earned. In 1885 Goldman took his son Henry and his son-in-law Ludwig Dreyfuss into the business and the firm adopted its present name Goldman Sachs Co.

Periodical employee contributions come directly out of their paychecks and may be matched by the employerThis legal option is what makes 401k plans attractive to employees and many. Insurance is a means of protection from financial loss. In 1882 Goldmans son-in-law Samuel Sachs joined the firm.

Corporate tax rates and statistics effective tax rates. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. Corporate tax individual income tax and sales tax including VAT and GST and capital gains tax but does not.

Individual Income Tax In Malaysia For Expatriates

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Solved Ezer Group Berhad Is A Leading Pharmaceutical Company Chegg Com

Starting New Business Post October 2019 How Much Tax You Will Save By Forming Company Or Llp Or Partnership

What Is The Tax Gap Tax Policy Center

Malaysia Company Tax Rate 2018 Gingerqwe

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Corporate Tax Rates Around The World Tax Foundation

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

What Is The Tax Gap Tax Policy Center

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Big Bang Reforms In India To Revive The Economy

Ranking Of The 50 Most Profitable Companies Worldwide 2020 Statista

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

What Is The Difference Between The Statutory And Effective Tax Rate

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Reduction In India What Should Bangladesh Do

0 Response to "company tax rate 2019 malaysia"

Post a Comment